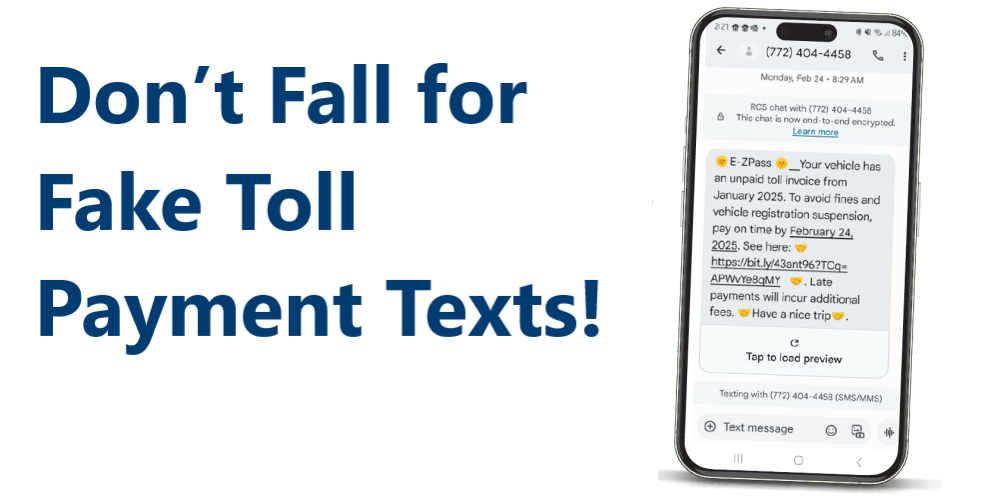

Don’t Fall for Fake Toll Payment Texts!

Scammers are getting creative, and one of the latest tricks involves fake texts about unpaid road tolls. These messages might...

Learn More5 Ways to Make Your CVCU Credit Card Payment

We offer five easy and convenient ways to make your Capitol View credit card payment. See how easy it is,...

Learn MoreAnnouncing Two New Mortgage Services

We have two new mortgage services available to Capitol View members. Whether you're dreaming of buying a new home, or...

Learn MoreBuying or Refinancing a Home – How to Know When the Time is Right

Thinking about buying a home or refinancing your current mortgage? Our free mortgage review is here to help you take...

Learn MoreWhere to Find Your 2024 Tax Information

Tax season will soon be upon us, and we want you to know where to locate your 2024 tax information...

Learn MoreA Message to the Members

Winter 2025 Member NewsletterBy: Benjamin Sheridan, CEO As the calendar turns to a new year, many of us take this...

Learn MoreA Message to the Members (Fall 2024)

We’ve been making a lot of changes at Capitol View Credit Union lately, and while these changes have been exciting,...

Learn MoreReceiving “Junk” Mail From Capitol View?

If you receive an official looking letter offering additional services after you've closed a Capitol View loan, look closely before...

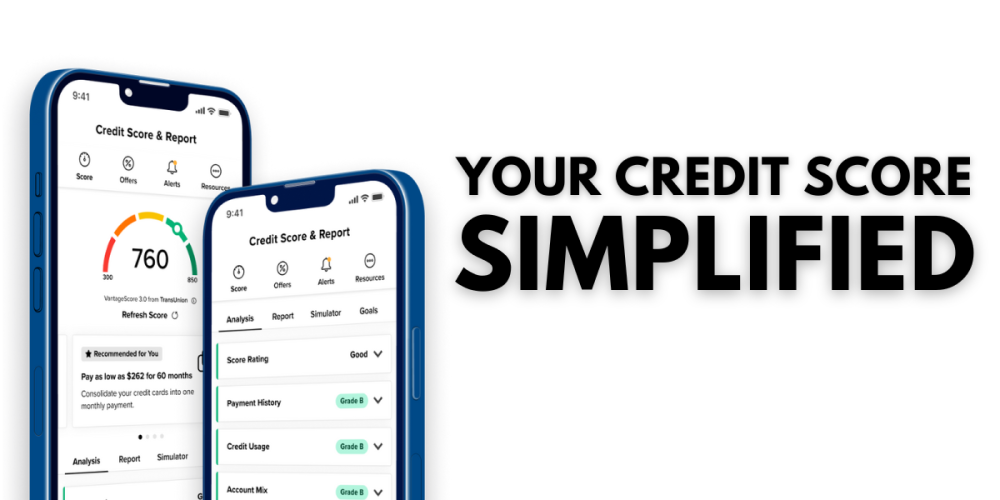

Learn MoreAnnouncing SavvyMoney

Access your credit score, credit report, personalized money-saving offers, and financial education tips on how to improve your score inside...

Learn MoreTo calculate the future value of a one-time, lump-sum investment, enter the dollar amount invested, the interest rate you expect to earn, and the number of years you expect to let the investment grow, then click the "Perform Calculation" button.

To calculate the future value of a monthly investment, enter the beginning balance, the monthly dollar amount you plan to deposit, the interest rate you expect to earn, and the number of years you expect to continue making monthly deposits, then click the "Perform Calculation" button.

Enter the term, rate, and either the payment or loan amount - the other will be calculated for you.

Fill out the form below using the cost of the vehicle, the total rebate, the dealer's interest rate, Credit Union's interest rate, and the length of the loan. Estimated payments will be calcualted, depending on where you borrow the money.

Thank you for visiting Capitol View Credit Union

You are now being connected to a third-party website not operated by Capitol View Credit Union. The privacy and security policies of third-party websites may differ from those of Capitol View Credit Union.